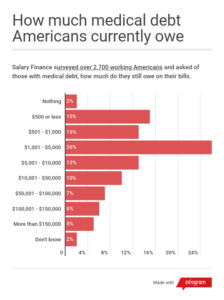

But being saddled with high amounts of medical debt is occurring with alarming frequency among those who work and are likely to have insurance. A survey of working Americans conducted by Salary Finance, a financial wellness benefits company, found that nearly a third of respondents report having medical debt. Of those with debt, about 28 percent report owing $10,000 or more. Another 26 percent report medical debt of anywhere from $1,000-$5,000.

The latest study looking at bankruptcy cases indicates that 66.5 percent of those forced into bankruptcy cite medical expenses or illness-related income losses as a major contributing factor to their poor finances. Many of those people have health insurance. For example, a cancer patient was told by the hospital that they accepted her employer-sponsored health insurance. “I paid my $300 co-pay. After my surgery, I started receiving all these invoices and came to find out the only thing covered was my bed because the hospital was out of network. My bills were hundreds of thousands of dollars, so I had no choice but to file bankruptcy,” said Susan LeClair of West Palm Beach, Florida in an interview in The Guardian.

What’s going on?

Having health insurance doesn’t guarantee you can afford needed care. And while affordability problems impact those with low incomes more often, the high costs of medical care have created hardships across the income spectrum. According to a Kaiser Family Foundation/LA Times Survey of adults with employer-sponsored health insurance, about half say someone in their household skipped or postponed medical care or prescription drugs because of the cost. Four in ten report difficulty affording some aspects of their medical care such as meeting deductibles or an unexpected medical bill.

People with employer-sponsored insurance who report having to make “a difficult sacrifice” because of health care costs have made some hard choices. Some actions are things anyone would do, such as cutting back on vacations or eating out. But responses in the Kaiser/LA Times survey included more extreme actions that could in and of themselves lead to poorer health outcomes. “I had to work three jobs at once. One full-time and two part-time jobs. Working from 4:30 am until 11 pm.” “Allowing my health to deteriorate because it’s too expensive to keep up with the cost of care.”

Pieces of the affordability puzzle

Overall, the problem centers on rising, uncontrolled costs: rising deductibles and co-pays; rising levels of premium sharing and co-insurance; chronic conditions which require constant and expensive treatments. And finally, unexpected bills for care that your insurance doesn’t cover and you weren’t made aware of before the care was provided. All these things have created a perfect storm where it’s difficult to know if you’ll be safe from crushing debt.

High Deductibles. A Data Brief produced by the Centers for Disease Control and Prevention (CDC) shows that enrollment in traditional employment-based health plans with lower deductibles is declining, while high-deductible plans are on the rise. For 2020, the IRS defines a high-deductible plan as one having an annual deductible of at least $2,800 for family coverage. The average deductible, according to the International Foundation of Employee Benefits Plans, for a high deductible plan is $4,104 for family coverage. Some respondents in the Kaiser/LA Times survey report deductibles greater than $5,000 annually for family coverage. Twenty-five percent of people in high-deductible plans say they’ve had difficulty affording their medical bills before meeting the deductible. Among those with a household income of $40,000 or less, 32 percent said they couldn’t afford paying a bill equal to their deductible at all.

Chronic Conditions. More than half of the respondents in the Kaiser/LA Times survey indicated they or a family member was currently receiving treatment for a chronic condition such as high blood pressure, serious mental illness, or asthma. A whopping 60 percent of those with chronic conditions reported skipping or postponing getting health care or prescription drugs in the past 12 months. For those in high-deductible plans, the figure jumps to 75 percent skipping or delaying medical care or drugs.

Difficulty understanding coverage and unexpected costs. Most also say they have difficulty understanding their coverage and/or the out of pocket costs they may incur. This is especially true when getting emergency care or services from providers you may never see, such anesthesiologists or surgical assistants. Out-of-network hospitals, doctors, and other services are another big source of “surprise” billings, and these charges can mount quickly. A study released in JAMA found that 20% of patients experienced out-of-network charges. The average amount for each bill the patient was responsible for was over $2,000.

Americans spend an average of about $5,000 a year on health care expenses, including insurance, prescriptions, and medical supplies, according to data from the U.S. Bureau of Labor Statistics. Insurance accounts for the biggest chunk of that $5,000 figure. Getting the most value for your insurance dollars is vitally important in today’s health insurance landscape.

A future post will review steps an individual – either with or without insurance – can take to protect themselves from sky-high medical bills.